Know Your Credit Score

Credit scores were a well-kept secret for many years. That has changed as a result of recent initiatives by the Consumer Financial Protection Bureau and Fair Isaac Corporation (FICO), which provides the most commonly used credit scores based on its proprietary software.

By April 2016, more than 150 million consumer credit-card and loan accounts included free access to the FICO® scores used to manage those accounts.1 This is an important benefit. Your score can influence loan approval and terms for a variety of financial transactions, not only for major purchases such as a home or an auto loan but also for the interest rate and limits on a credit card, the cost of insurance premiums, and approval on a home rental. It might even affect a job application.

Three Key Digits

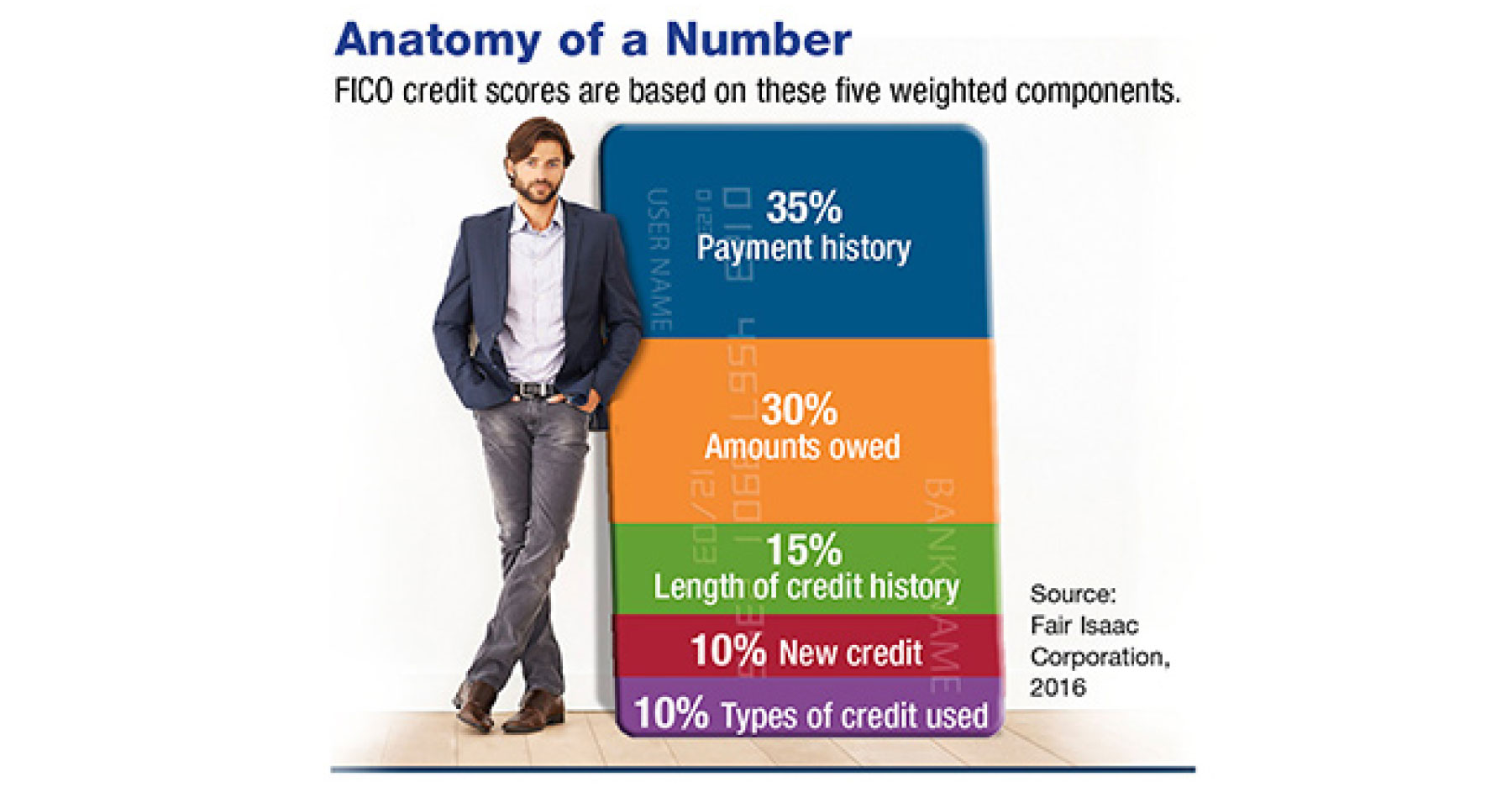

The FICO score is a three-digit number ranging from 300 to 850. The score is derived from a formula using five weighted components (see chart). Different versions of this score are available to lenders, and the score you see on your account may not be the same score that another lender would use. But it should be a good guideline.

Here are some tips that might be helpful if you want to improve your score or maintain a current high score:

- Use at least one major credit card regularly and pay your accounts on time. Setting up automatic payments could help avoid missed payments.

- If you miss a payment, contact the lender and bring the account up-to-date as soon as possible.

- Keep balances low on credit cards and other revolving debt. Don’t “max out” your available credit.

- Don’t open or close multiple accounts within a short period of time. Use older credit cards occasionally to keep them active. Only open accounts you need.

- Monitor your credit report regularly.

You can order a free credit report annually from each of the three major consumer reporting agencies at annualcreditreport.com or by calling (877) 322-8228. If you find incorrect information, contact the reporting agency in writing, provide copies of any corroborating documents, and ask for an investigation. For more information, visit consumer.ftc.gov/articles/0155-free-credit-reports.

1) Fair Isaac Corporation, 2016

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright 2016 Emerald Connect, LLC.